Cheque Writer

This online Checque writing application will help you in filling a Cheque in right manner and avoid mistakes to save cheque leaf's for you. The cheque writer application has inbuilt Number to Words converter, so you need to enter the amount in digit and rest of the work done by the cheque writing tool.

| Bank Name | XXXXXX XXXXXX XXXXXX XXXXXX XXXXXX TEL : XXXX-XXXXXX IFSC CODE : XXXXXXXXXXX |

VALID FOR 3 MONTHS ONLY | ||||||||||||||||||||||||||||||||||||||||||

d |

d |

m |

m |

y |

y |

y |

y |

|||||||||||||||||||||||||||||||||||||

| D | D | M | M | Y | Y | Y | Y | |||||||||||||||||||||||||||||||||||||

| PAY | OR ORDER |

|||||||||||||||||||||||||||||||||||||||||||

| RUPEES | ||||||||||||||||||||||||||||||||||||||||||||

| ₹ | ||||||||||||||||||||||||||||||||||||||||||||

| A/c No. | XXXXXXXXXXXX | |||||||||||||||||||||||||||||||||||||||||||

| (Company/Your Name) | ||||||||||||||||||||||||||||||||||||||||||||

| MULTI CITY CHEQUE PAYABLE AT PAR ALL BRANCHES OF BANK | PLEASE SIGN ABOVE | |||||||||||||||||||||||||||||||||||||||||||

| XXXXXX - XXXXXXX - XXXXXXXX | ||||||||||||||||||||||||||||||||||||||||||||

| Bank Name | XXXXXX XXXXXX XXXXXX XXXXXX XXXXXX TEL : XXXX-XXXXXX IFSC CODE : XXXXXXXXXXX |

VALID FOR 3 MONTHS ONLY | ||||||||||||||||||||||||||||||||||||||||||

d |

d |

m |

m |

y |

y |

y |

y |

|||||||||||||||||||||||||||||||||||||

| D | D | M | M | Y | Y | Y | Y | |||||||||||||||||||||||||||||||||||||

| PAY | OR ORDER |

|||||||||||||||||||||||||||||||||||||||||||

| RUPEES | ||||||||||||||||||||||||||||||||||||||||||||

| ₹ | ||||||||||||||||||||||||||||||||||||||||||||

| A/c No. | XXXXXXXXXXXX | |||||||||||||||||||||||||||||||||||||||||||

| (Company/Your Name) | ||||||||||||||||||||||||||||||||||||||||||||

| MULTI CITY CHEQUE PAYABLE AT PAR ALL BRANCHES OF BANK | PLEASE SIGN ABOVE | |||||||||||||||||||||||||||||||||||||||||||

| XXXXXX - XXXXXXX - XXXXXXXX | ||||||||||||||||||||||||||||||||||||||||||||

How to use Cheque Writer

1. Enter the amount, Name and Cheque issuing date and press fill Cheque button.

2. Now you will see your cheque filled with all required details like - Payee Name, Date, Amount in words and amount in Digits with proper comma separations format.

3. You can copy the cheque details to use it further or fill your physical cheque with completer details and proper format.

The cheque writer tool can write and print cheque in both English and Hindi language and Indian Number Format with proper comma separation for better reading of cheque details and minimize chances of mistake in cheque writing.

How to Fill Cheque

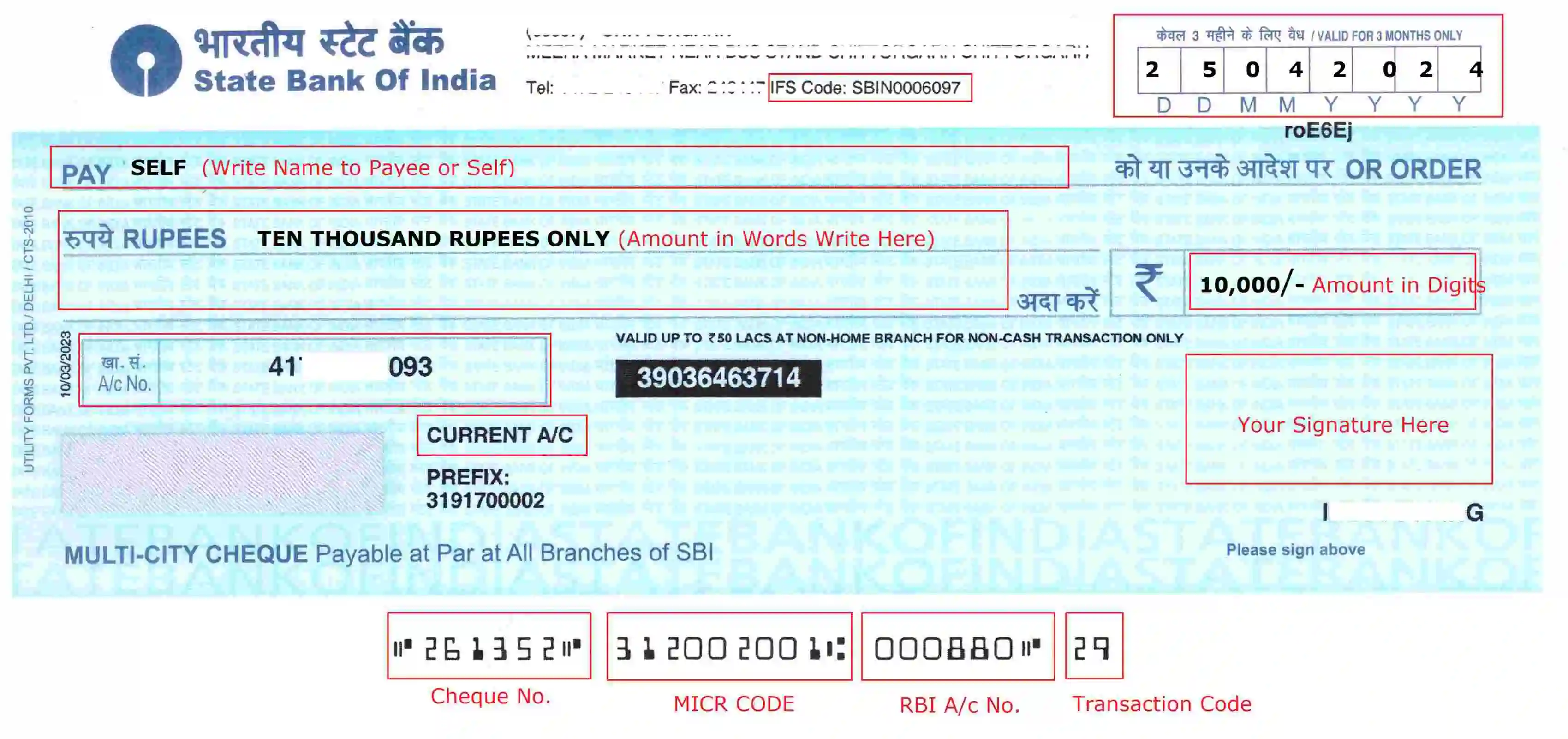

Filling a Cheque is very simple for those whos are used to it, but for new comers it will be a task, a bank Cheque leaf has many important information printed on it. You can see the image given below and fill your Cheque easily.

In writing a Cheque you have to fill following information:

1. Date : You have to fill date of issuing Cheque. In India Cheque is valid for three months from the issuing date.

2. Pay : Here you have to fill the name of person or company you are paying. In case of you are withdrawing cash you have to write "Self".

3. Rupees : Fill the amount in words.

4. Amount in Digits : Fill the amount in digits and at end put a backslash sign to prevent any unauthorized correction.

5. Signature : After complete filling and dual checking sign on Cheque.

Various printed information on Cheque leaf are:

1. Branch Code : It's bank branch code with the help of branch code you can know the branch location and address.

2. Bank Branch Address : Bank branch address with telephone number is places on top bar as you can see in above image.

3. IFSC Code : The IFSC full form is Indian Financial System Code is an 11-digit alpha-numeric code that facilitates the online transfer of funds between accounts. The code is unique for every branch of the bank. For example in above image IFSC code is : SBIN0006097

4. Account Number : Your account number will be printed on cheque book.

5. Account Type : Some banks prints account type also like saving a/c or current a/c on cheque leaf.

6. Account Name : In some banks account name is printed on cheque book. You have to sign just above it.

7. Cheque Number : Cheque number is printed on each cheque leaf as showing in above image. It's a good practice to note-down Cheque number, amount and payee name on cheque book record slip. Cheque number is an important no. to track the transaction. For example in above image Cheque No. is : 261352

8. MICR Code : MICR Code full form is Magnetic Ink Character Recognition. It is a unique nine-digit code to identify a bank and branch participating in the Electronic Clearing System. The RBI assigns every bank branch a unique MICR Code. For example in above image MICR code is : 31200 2001

9. RBI Account Number : RBI Account number also printed on Cheque leaf's.

10. Transaction Code : It can be range from 01 to 30 (31 to 49 is also reserved for future use). It will be used for represent Nature of Transaction / Instruments.